AI to boost your physical network’s business impact.

Banks are facing significant challenges in their branches network: how to guarantee and deliver the best customer service while facing a decrease in frequentation and the need to reduce costs?

Through this use case, discover the AI solution we have developed to answer this question.

Context

Retail banking physical networks are reducing their presence on the territory to cope with the drifting costs of their activity, as well as the decline of customers visits to bank branches as a result of the digitalization of customer experience. Banking institutions are therefore obliged to close their branches and pool spaces to accommodate different kinds of customers, especially those targeted for mass market customers.

Furthermore, the banking relationships are undergoing a profound transformation: on the one hand, customers want to have digitized processes; on the other and, they are seeking advice, particularly for the most important moments in their lives (e.g. real estate purchases) or because their needs require expertise (e.g. tax exemption).

The location of branches, but most importantly of banking advisors, is thus a key stake for banks in order to capture customers with the highest potential and support them. Leveraging AI technologies allow to improve network operations by placing advisors where they’re most needed. The use case developed in the next page falls within the scope of a customer acquisition objective, aiming to optimize the presence of advisors in areas to be developed, and can be adapted to all types of customers.

Proof Of Concept: How to best capture retail banking market-share for small businesses?

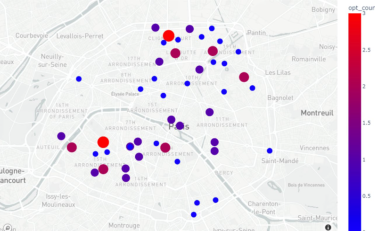

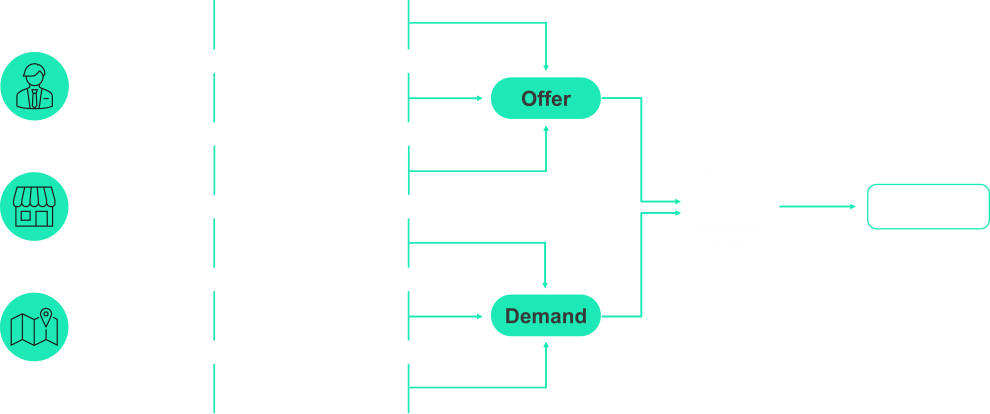

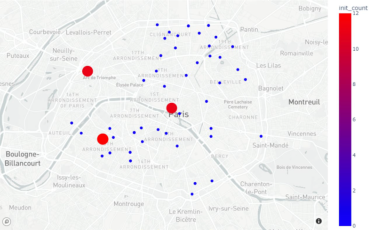

Our aim is to model the imbalance of demand for banking advice and the presence of banking advisors. An optimization model will assign advisors to branches in such a way that the imbalance is minimized, hence maximizing the opportunities for capturing market shares.

In the context of this analysis, the customer base considered is limited to business customers with a turnover of less than 3 million euros in the city of Paris, France.

The territory is divided in 200x200m chunks, linked to the closest branch. A careful forecast of the economic attractiveness of each chunk provides an estimation of the demand in each area. Each advisor has a potential for capturing part of the demand, depending on his past performance and skills.

Inputs:

Market share capture potential — generated data - Network of branches: localization, min/max number of advisors - Advisors: specialty and past performance

Demand modeling: open data - Location of competitors - Economic attractiveness of the area (population, number of businesses, …)

Outputs:

Individual optimal placement of advisors

Results